HM Government’s target is for all British Citizens aged 15 years and above to have a Britizen account; and for as many of these accounts as possible to be used regularly. Participation will be voluntary initially; the government’s intention is that the platform has become ubiquitous before participation is made compulsory.

This post outlines how the number of Britizen users, speed of adoption and continued use of the platform will be facilitated.

Value Proposition

A value proposition is an innovation, service or feature intended to make a product or company attractive to customers. A value proposition shows how the product solves customer problems; improves their situation; or offers specific benefits.

Like Sesame Credit, Britizen offers tangible benefits to members which increase with their Britizen score. These benefits are designed to nudge or encourage members to support British values, promote trust and create a better society. Trust is encouraged by both rewarding trustworthy behaviour and allowing third parties to use an individuals’ credit score to assess them. Initial benefits are designed to appeal to a broad section of the population, and include tax reduction, priority in government housing, and discount vouchers for British services.

At a time of increasing concern about globalisation, using Britizen is a practical way people can demonstrate support for British values, culture, innovation and business.

Rogers Adoption Criteria

Rogers Diffusion of Innovations (Rogers, 1983) defined five criteria material to the adoption of new ideas and products: relative advantage, compatibility, complexity, trialability and observability.

These factors have been considered when determining the requirements and design of Britizen, to help ensure consumers are willing to try the platform.

Relative advantage: is outlined in the value proposition. Britizen will return most surplus profit to members in the form of tiered benefits with broad appeal. Tax benefits are targeted to better off users; priority on government housing waiting lists appeals to ‘strivers’ struggling to afford a home in modern Britain. As Britizen matures business sponsors and advertisers will be encouraged to extend the user benefits with special offers, discounts and tokens with appeal to a broad spectrum of users. This contrasts with the approach of private corporations; which are operated for profit.

Compatibility: Britizen will contain the features familiar to online social network users.

Complexity: Britizen will be intuitive and simple to use on a wide variety of devices.

Trialability: there is no charge to use Britizen; the only requirement is to have a valid National Insurance number.

Observability: Initially advertising and other marketing techniques will be used to make people aware of Britizen. The gamification component of Britizen scores will encourage people to discuss and compare their scores; users will be motivated to encourage others to sign up to enhance their own score. Early sponsors will be carefully chosen visionary and imaginative businesses who will produce exciting, attractive materials which make the site more attractive and appealing. Influential users will be identified a encouraged to encourage others to join.

Rogers Adoption Model

Rogers defines five categories of user over the product lifetime: innovators, early adopters, early majority, late majority and laggards. At this stage, the focus is from start up to a majority of the UK population using Britizen.

Sponsors will be selected to appeal to the type of user likely to join at each stage. Celebrity endorsement will be used to appeal to different user categories; network analysis will be used to identify less public members who are likely to be influential; those with high degree centrality, nodal betweenness and/or occupy structural holes. These members will be targeted to encourage others to join.

Mavens, Connectors and Salespeople

Gladwell’s Tipping Point (Gladwell, 2000) describes the importance of three different groups of people in influencing the spread of behaviour, which he calls Mavens, Connectors and Salespeople.

Mavens are known and respected for having expertise in specialised areas which they are willing to share. Martin Lewis’ Money Saving Expert[1] is an example of an influential British website highly respected for its specialised knowledge in how to save money. Information and advice about the benefits of Britizen from this site will help generate visibility and trust as well as providing encouragement to join Britizen.

Connectors are particularly valuable because they have connections to many people and often act as bridges between groups or clusters in social networks. Their ability to bridge groups is also important in spreading Britizen widely throughout the population.

Salespeople (also known as evangelists) have the skills to persuade people and convince people to action.

Not all mavens, connectors and salespeople act in professional or paid capacities. Network analysis of the Britizen graph will be used to identify members who are likely to be influential; those with high degree centrality, nodal betweenness and/or occupy structural holes. These members will be specifically encouraged to persuade others to join Britizen.

Network effects (Direct, Cross & Indirect)

Direct Network Effect: The value of an online social network increases with the number of members; the higher percentage of an individual’s contacts using the network the more useful it is to that person. There tends to be a critical mass or ‘tipping point’ (Gladwell, 2000) of membership beyond which membership increases rapidly in a similar way to an epidemic. Once a network achieves ubiquity there is pressure for laggards to join to avoid being left out.

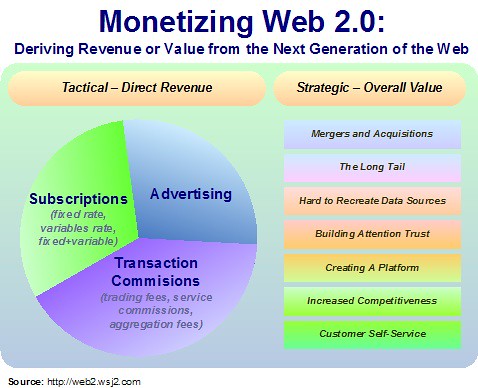

Cross Network Effect: occurs when a rise in one group of users makes the network more valuable for another group of users. For Britizen there is a symbiotic relationship between users and sponsors/advertisers. The sponsors and advertisers benefit directly from a larger user base. The benefits available to users will increase as the revenue generated from sponsors and advertisers increases. This is covered in more detail in my post about the Britizen Revenue Model.

Indirect Network Effect: is generated when third parties create complementary goods. This process is helped by having a reliable Application Programming Interface (API) and publishing easily useable ‘five star’ open data [2]. Third parties are more likely to be interested in developing related products once Britizen has an established user base.

Marketing Campaign

A carefully focussed marketing and advertising campaign will be used to:

- foster the rapid initial adoption of Britizen until the tipping point is reached

- maximise the opportunities afforded by the influencers outlined above

- target groups of the population where uptake is relatively low

- market the benefits of sponsoring Britizen to British businesses

References

Gladwell, M., 2000. The Tipping Point. Little, Brown and Company.

Rogers, E.M., 1983. Diffusion of Innovations, 3rd ed. Collier Macmillan, New York.

[2] http://5stardata.info/en/